This is not investment advice, do your own research before considering making an investment in Bolloré SE or Cie de l’Odet. At the time of writing I am holding long positions in Bolloré SE and Cie de l’Odet shares. These positions may be reversed by me at any time and without further notice.

Bolloré SE is a holding company controlled by the family of Vincent Bolloré, a well-known french business man. The shares of the company are listed on Euronext Paris. At the time of writing the shares are being traded for around EUR 6, which is less than half the true value per share. Recently, the company has started simplifying its Gordian Knot structure of holding companies. This overly complex structure has had the effect of masking the true ownership proportions of Bolloré from the casual observer. In my opinion it is one of the main causes for the very large discount at which the shares are trading. Therefore, this simplification project could very well be the catalyst that will unwind the discount.

First, let’s have a look at Bolloré’s balance sheet. The vast majority of the company’s assets are invested in companies for which market prices are readily available, and the rest is a large net cash position. So valuing the assets is relatively straightforward. The table below gives a simplified overview of the net asset value of Bolloré SE. (numbers taken from Annual Report 2023 and Semi-Annual Report 2024)

The table shows a large stake (18%) in UMG which is traded on Euronext Amsterdam and worth EUR ~ 8 bln. Vivendi has at the end of 2024 split into 4 companies. All of these are listed on European exchanges and taken together the value of the 30% that Bolloré is still holding in each of them is worth EUR ~ 2.4 bln.

Of minor importance are the Bolloré Energy and Bolloré Industry groups. I put a value of zero on Bolloré Industry since this has been a loss making endeavor for years. Bolloré Energy does make money and could be the next African Ports or Logistics business where Vincent Bolloré hones his deal making prowess and builds this into a multi-billion dollar enterprise and sells it at the top of the market to a strategic buyer. For now, I value it conservatively at EUR 300 mln.

Finally, there is the position in Cie de l’Odet. More on this in a minute, since this is the part that is most likely not properly understood by the market. For now, we will use the same method to value the position as Bolloré does in its financial reports. Cie de l’Odet is quoted on Euronext Paris at a price of EUR ~ 1600 per share. The share capital of Cie de l’Odet is divided in 6.6 bln shares. Through a web of companies, Bolloré SE effectively owns more than 84% of those shares. At EUR 1600 per share this stake is worth EUR 8.5 bln. 1

Adding up all the parts gives us a net asset value of EUR 25 bln, Bolloré has 2.8 bln shares outstanding which leads to a NAV per share of EUR ~ 9.00. With the Bolloré SE shares at EUR 6 this means that according to the above calculation they are trading at a 33% discount.

~30% is actually a pretty standard discount for European listed holding companies these days, so you could argue that Bolloré as an investment opportunity is nothing special. However, as mentioned before, the actual discount for Bolloré shares is more like 55%, meaning you can buy the shares for less than half their net asset value. On top of that, Bolloré has started to disentangle the dense web of holding companies that have Cie de l’Odet as their ultimate asset. Undoing this complexity should make it easier for investors to grasp the true value of Bolloré, and could be the catalyst to unlock it.

Self-control loop taken to its extreme

I encourage you to take a look at the detailed organization chart that the company publishes on it’s website 2. While you study it, keep in mind that a lot of detail has actually been left out! There are cross-holdings between companies left and right, and it actually becomes circular in a few instances. But if you take a step back, the result is that Bolloré has full (at a minimum 95%) ownership of all these companies, and apart from some minor investments, the ultimate asset that is contained within these companies is share ownership of Cie de l’Odet.

Let’s look at a simplified ownership chart of Cie de l’Odet.

The bottom row of the pyramid chart shows that Cie de l’Odet is 56.1% owned by a holding company named Sofibol, 35.5% of the shares are owned through companies fully owned by Bolloré, 7.3% of the shares are owned by the public, and 1.1% is directly owned by Bolloré Participations. Bolloré Participations sits at the top of the pyramid and is 100% owned by the Bolloré family. What the chart furthermore shows, is that with minimal investment, Bolloré Participations has majority ownership of Cie de l’Odet and control of almost all of the votes. This is because Bolloré Participations owns 50.2% of Omnium Bolloré, which in turn owns 50.3% of Financiere V, which in turn owns 51.1% of Sofibol. The rest (slightly less than 50%) of these companies always belongs to Bolloré SE and, moreover, to comply with the french commercial code Bolloré SE has no voting rights in any of these companies. Bolloré SE also has no voting rights on its 35.5% stake in Cie de l’Odet, and thus Sofibol with 56.1% of the shares controls 92.7% of the votes in Cie de l’Odet. And these votes are fully controlled by Bolloré Participations.

If we collapse pyramid structure, then it becomes clear how Bolloré Participations controls almost all of the votes with a less than 10% share of the capital of Cie de l’Odet. Whereas Bolloré SE with 84.4% owns the vast majority of the capital.

What does this have to do with the discount of Bolloré SE? Well, for that we have to look at the balance sheet of Cie de l’Odet. And there we can keep it short, basically the only asset of significance on the balance sheet is a 67% stake in Bolloré SE. That’s right, Bolloré owns almost all of the company that owns 67% of itself. To be precise, Bolloré SE owns 84.4% of 67% of its own shares, which comes out to be 57%. 3

note: Bolloré SE already held 3% of its own shares in treasury per 31-12-2023, subsequently these shares have been canceled.

When a company directly owns its own shares, these are called treasury shares and have no voting and dividend rights. The company can either sell them again, grant them in employee share ownership programs, or cancel them. As long as they stay in treasury, you can subtract them from the number of shares outstanding to use in your calculations for earnings per share etc. Now in this case, Bolloré owns 57% of its own shares in a roundabout way. Does that change anything about how these ‘treasury shares’ should be treated then? Well, yes and no.

On the one hand, Bolloré SE does not have direct access to the assets of Cie de l’Odet so the option to cancel these shares for example, is not available to Bolloré SE. In that regard, they are not truly treasury shares. On the other hand, the dividends that Bolloré SE pays on its shares and are received by Cie de l’Odet do accrue to Bolloré (for its 84.4% share), and if Cie de l’Odet would pay out all dividend receipts as a dividend of its own, the money would flow right back into Bolloré SE’s coffers. In theory Cie de l’Odet could even dissolve and distribute its assets to shareholders, and the holding companies above it could all do the same. In that scenario Bolloré would receive 57% of its own shares, and would have to cancel them (under french law companies are limited to holding a maximum of 10% of the shares outstanding in treasury). In practice however, that will not happen because along the way Vincent Bolloré would lose majority control of Bolloré SE.

So now we have established the full picture of ownership of Bolloré SE, let’s see what that means for the net asset value per share.

When we consider the investment in Cie de l’Odet as in actual fact being a position in treasury shares, then we can reduce the effective number of shares outstanding for Bolloré SE by almost 60%. This shrinks the number of shares outstanding from 2.85 bln shares to roughly 1.15 bln shares. The net assets of Bolloré SE excluding Cie de l’Odet are worth EUR 16.5 bln. That leads to a NAV per share of more than 14 euros. Compare that to the current share price of approximately 6 euros and you have yourself a nice margin of safety.

What about Cie de l’Odet?

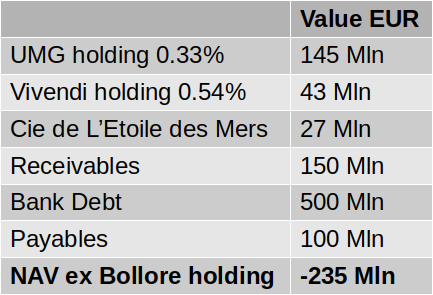

Valuing Odet is pretty straightforward now that we have established the mechanics of the self-control loop. On the balance sheet appears the 67% ownership of Bolloré, and then the following:

Bolloré has a NAV of 16.5 bln EUR plus 84.4% ownership of Odet. So, Odet has effectively:

57% treasury shares (67% of 84.4%)

67% ownership of the NAV of Bolloré of EUR 16.5 bln worth EUR 11 bln

other assets and liabilities adding up to a deficit of EUR 235 mln

There are 6,585,990 shares of Odet outstanding. Reducing this by the 57% treasury shares gives us an effective share count of 2.86 mln shares. The NAV is 10.8 bln EUR, which leads to a NAV per share of roughly EUR 3750. Currently the shares trade hands for almost EUR 1600.

How will this value be unlocked?

Bolloré has started the process of simplifying the web of various holding companies by initiating a few mergers and public squeeze out offers for some of the companies that are responsible for maintaining the self-control loop. 456 This has led some stockholders of Bolloré and Odet to speculate about possible follow-on scenarios. One scenario that seems plausible is the subsequent squeeze out of the minority interest in Cie de l’Odet. This minority interest amounts to only 7% or so, and would cost Bolloré somewhere between EUR 650 mln (at the current share price) and EUR 1.5 bln (using fair value price of EUR 3750). With almost EUR 6 bln of net cash on the balance sheet of Bolloré, this is certainly a feasible option. And most importantly, Bolloré Participations would still have majority control of Bolloré following this action. But if and when this will happen remains uncertain.

Personally, I treat the discounts in Bolloré and Odet as a free option that may one day pay off big time. In the meantime, Vincent Bolloré has a proven track record of being a shrewd businessman able to create significant value for his shareholders. The recent sales of the African ports and logistics businesses prove that, and you can look at the long term chart of Bolloré SE to see for yourself what he has achieved over the years.

I am certainly not the first one to recognize and write about the undervaluation of Bolloré SE and Cie de l’Odet. What I have not seen in any of those other articles is a detailed explanation of the holding company structure at the Bolloré galaxy and how it leads to such a large proportion of self-ownership. I hope to have made it clear in this article that more than half of the shares of Bollere SE and Cie de l’Odet are effectively treasury shares and the effect that it has on the fair value per share of the remaining shares outstanding.

See page 243 of the 2023 Universal Registration Document note 8.3 ‘Other Financial Assets’ subheading ‘Portfolio of listed and unlisted securities’ subsubheading ‘Sofibol, Financière V, Omnium Bolloré’.

Cie de l’Odet has some other assets as well as EUR 500 mln in debt, see the section in this article on Cie de l’Odet for a detailed look at the balance sheet and valuation

https://www.financiere-moncey.fr/fr-fr/presse/communiques/ for information on the merger of Tramways de Rouen into Financiere Moncey and the subsequent squeeze-out offer for Financiere Moncey minority holders

https://www.compagnie-du-cambodge.com/fr-fr/presse/communiques/ for information on the merger of Societés des Chemins de Fer du Var et du Gard into Compagnie du Cambodge and the subsequent squeeze-out offer for Cie du Cambodge minority shareholders

https://sif-artois.fr/fr-fr/presse/communiques/ for information on the squeeze-out offer for Societé Industrielle et Financiere de l’Artois

everybody knows about the web of cross share ownership ownership in the bollore family so Im not sure that simplifying that will revalue the share price. maybe. but it cannot be that the reason of the discount is the lack of understanding of the share structure, there are a gazillion posts about the topic. it is basically the thesis of every fund manager who invests in Bollore. I think sp may go up 10-20% on the hype if some simplification happens and then will return to where it was before the announcement. Something like this happened with the last announcements in 2024, a bit of hype and then nothing.